IBAN Suite: Eliminate Failed Payments with IBAN Validation

Validate payment details instantly at the point of entry. Reduce rejected transactions, automate compliance and streamline operations with our global IBAN validation engine.

Bank-Grade Accuracy

Data sourced directly from official directories and updated daily for maximum reliability.

Global Coverage & Compliance

Full support for 100+ countries, ensuring seamless SEPA compliance and domestic validation.

Automated Enrichment

Instantly retrieve BIC/SWIFT codes and bank branch details from a single IBAN.

Developer-First Integration

Integrate our powerful REST API into your software in minutes not days.

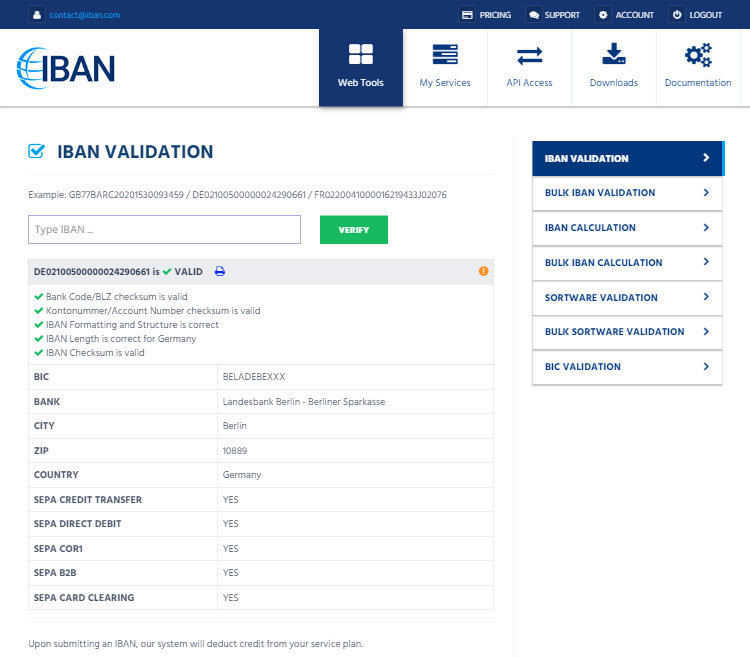

More than just error checking

Our IBAN Suite service performs multiple layers of validation ensuring the minimal chance of error in payment details.

Additionally, it provides bank data vital to cross-border payments such as BIC, Bank and Branch details for payment routing and payment schema support such as SEPA ( SCT, SDD, Core ).

To ensure data quality, our system uses bank data licensed by reliable sources such as national banks, financial institutions and issuing agencies.

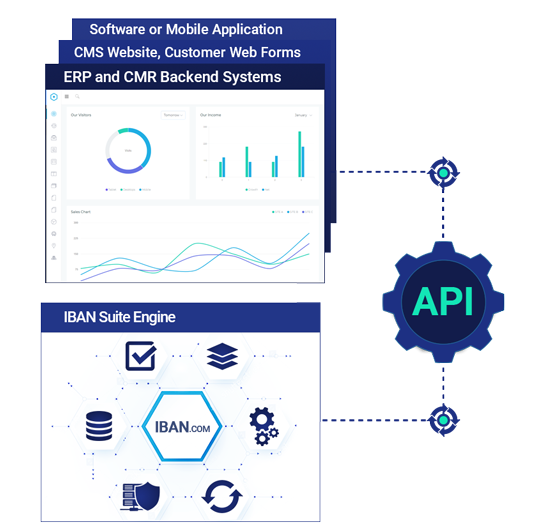

Integration

We have developed a simple-to-use, yet powerful set of APIs which allow you to connect our system to any point of your application's work flow.

Implementing IBAN validation functions in the input of your payment management system, CRM, ERP or finance software can be done with a single request to our service.

Supporting both REST and SOAP protocols, our technology can be easily connected with the most corporate management software solutions such as SAP, SalesForce, Sage etc.

Under the hood

Key features provide a comprehensive solution for validating payment details

- Validate the internal check digit of an IBAN

- Validate internal structure of an IBAN

- Validate the length of the IBAN

- Identify SEPA reachability

- Retrieve BIC code of an IBAN

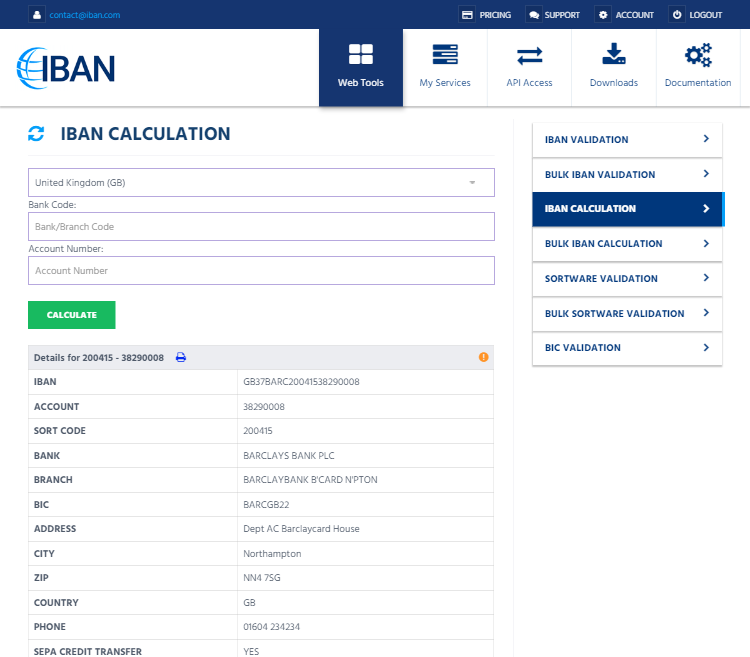

- Convert bank code and account number to an IBAN

- Recover an IBAN containing unreadable/unknown characters

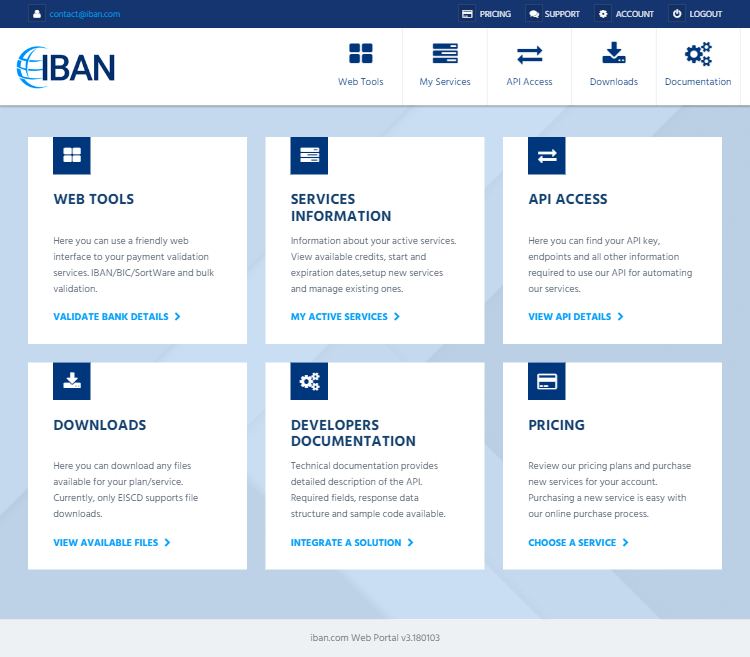

Simple and powerful

We have tailored key features for efficiency and flexibility when using our services

- Mobile friendly web interface

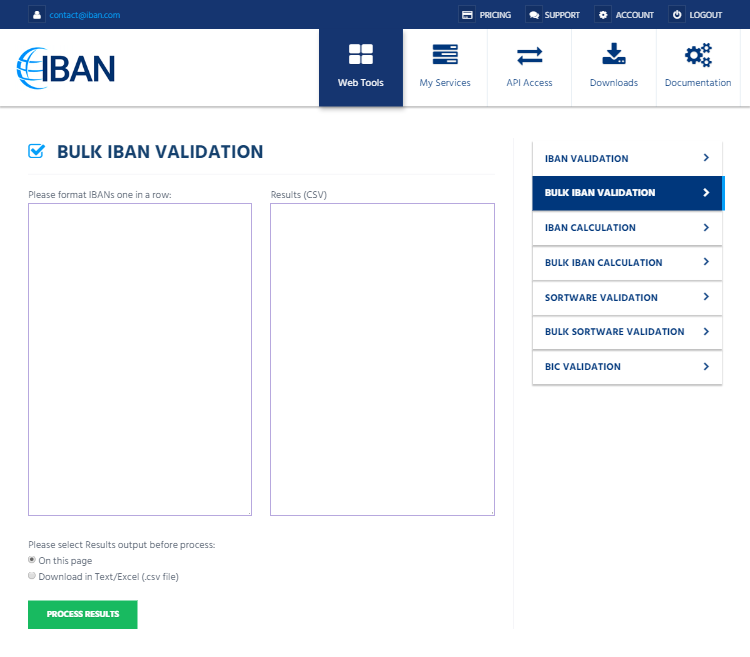

- Mass/Bulk IBAN Validation

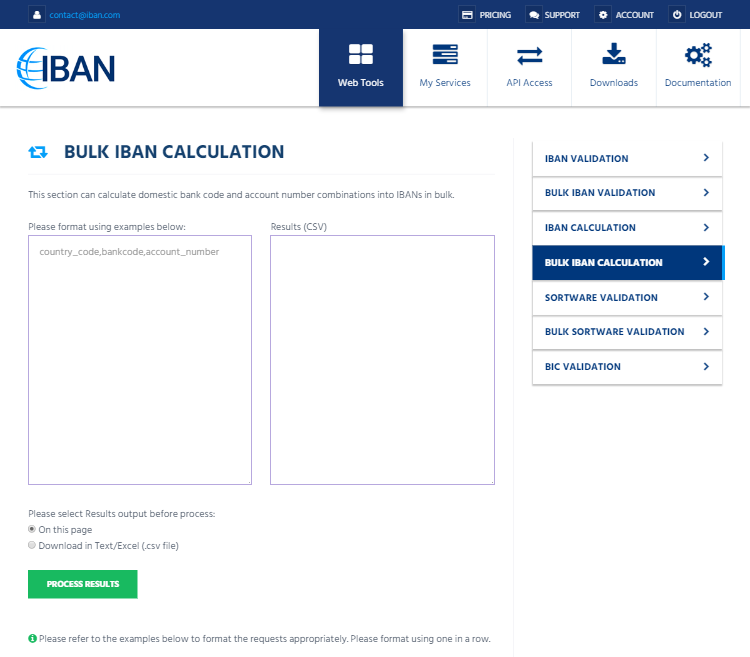

- Mass/Bulk IBAN Calculation

- Sub-user accounts for company employees

- Manage API Access Lists

- Single call REST and SOAP API

- IBAN Validation API

- IBAN Calculation API

- IBAN Recovery API

To provide the best results, we work in steps. We will run a number of checks to ensure you have the most detailed result from the validation process.

1. Data cleansing

At this first step we remove all non-alphanumeric characters and report if we encounter invalid ones.

2. IBAN Check Digit

Integrity check on the IBAN using ISO 7604 (MOD 97-10) algorithm is performed at this step.

3. Account Number Check

Domestic bank account validation is performed based on country-specific algorithms.

4. IBAN length

Verifying the total length of the IBAN according to the country standard to make sure it's correct.

5. Format/Structure

The IBAN's internal components are checked for correct format and respective positions.

6. Bank Directory Lookup

We identify the issuing bank and country along with the BIC and SEPA payment schema support.

Included Features

| All IBAN Suite plans provide the following features | Included |

|---|---|

| Web interface | |

| API access (REST & SOAP) | |

| IBAN Validation | |

| IBAN Conversion | |

| Bulk Validation (Mass IBAN Validations) | |

| Bulk Conversion (Mass IBAN Calculations ) | |

| Support all official IBAN countries (including SEPA) | |

| Support experimental IBAN countries | |

| Data cleansing (Remove all non-alphanumeric characters) | |

| Check if country support IBAN | |

| Check IBAN against MOD 97 (ISO 7064) | |

| Check for IBAN length for selected country | |

| Check IBAN format and structure | |

| Account Number checksum in BBAN (if available) | |

| Providing BIC for all IBAN countries | |

| Bank/Branch | |

| Address, Country | |

| SEPA Scheme Reachability (SCT, SDD B2B, SDD Core) | |

| Guaranteed Uptime SLA 99.9% | |

| Data encryption | |

| Mirror Backup Server |

Solutions

- Improving Payments - Validate an IBAN and retrieval of bank details prior to processing to streamline payments.

- Data Cleansing - Cleanup old data by performing a mass/batch IBAN Validation searches on existing payment details in your system.

- Data Recovery - Using our IBAN recovery API businesses who manually digitize IBAN data can recover IBANs which contain missing or unreadable characters.

- User Input Validation - Validate payment data upon user entering the IBAN in the system. Protect against typing errors.

- User Input Auto-complete - Provide better user experience by retrieving bank details and BIC code when user enters an IBAN in your system.

- Compliance - Helps businesses comply with resolution 092/05 issued by the European Payments Council regarding mandatory use of BIC and IBAN.